The Dallas Fed looked at multiple indicators to conclude that a Housing Bubble is probably forming.

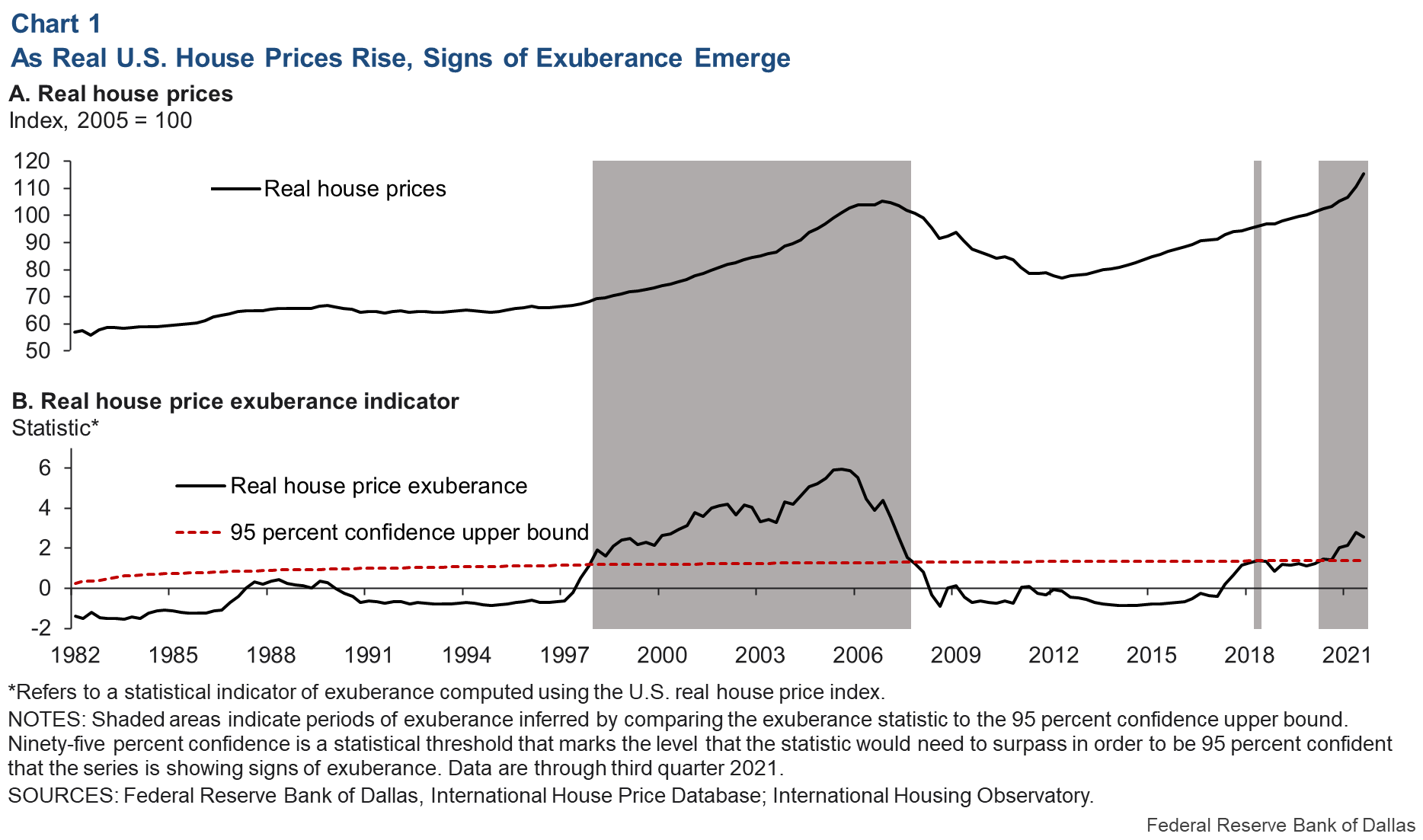

They started by looking at exuberance, rapid increases in absolute housing prices, and found indications of “exuberance” starting around 2020.

They noted that the U.S. is not alone in experiencing housing market fever. Eleven of the 25 countries in the Dallas Fed’s International House Price Database show signs of real house-price exuberance.

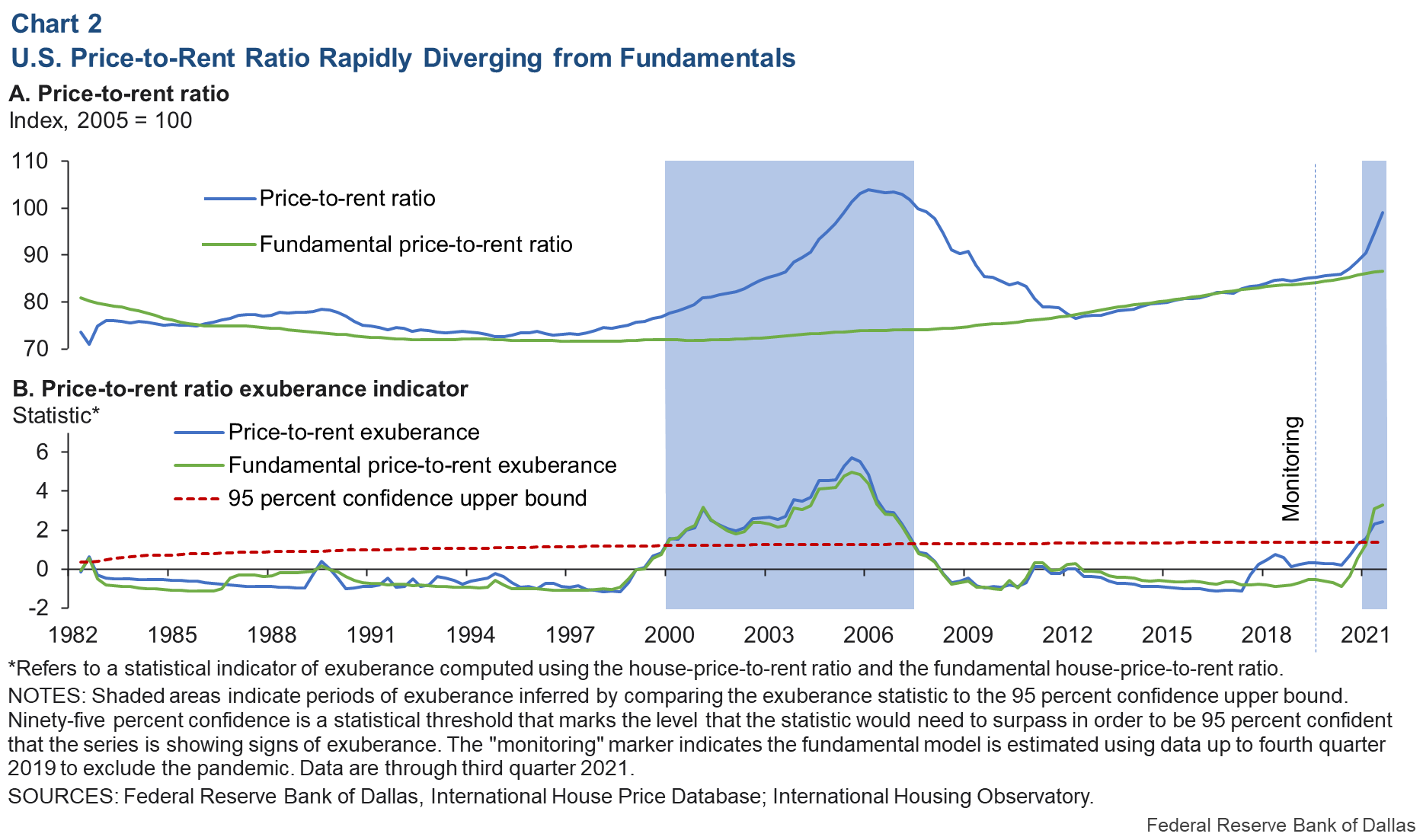

They then looked at a price to rent ratio. This is something that investors like me also consider strongly. The general rule of thumb is that if a house can be purchased for 100x one month’s rental value, it will cash-flow.

They state that price to rent is the fundamental value of housing based on the sum of discounted future rents. This is similar to the finance tenet that the fundamental value of a company’s stock is the flow of future dividends discounted by the cost of capital.

They concluded that the price to rent ratio is rapidly diverging from fundamentals.

The gap between the actual price-to-rent ratio and its fundamental-based level in the U.S. has grown rapidly during the pandemic—comparable to the run-up of the last housing boom—and started showing signs of exuberance in 2021.

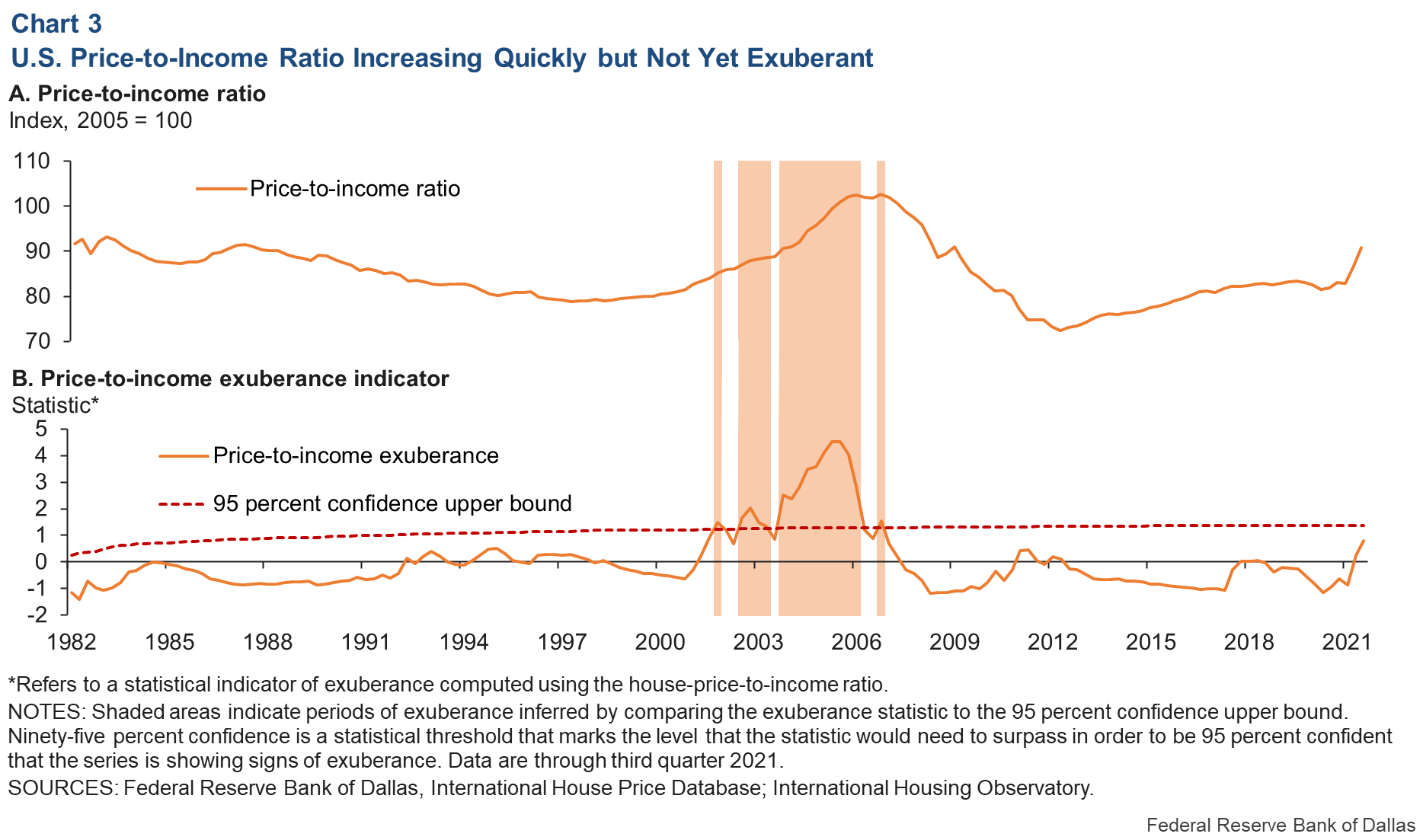

They then looked at ratio of house prices to disposable income. This is an indication of affordability.

They concluded that price to income is increasing quickly but is not yet exuberant.

They concluded that their evidence points to abnormal U.S. housing market behavior for the first time since the boom of the early 2000s. Reasons for concern include the price-to-rent ratio, and the price-to-income ratio. These ratios are out of step with normal ratios.

They believe that, while low interest rates are a factor, they do not fully explain the housing situation. Other drivers include pandemic-related stimulus programs and COVID-19-related supply-chain disruptions and associated policy responses. There is also a fear-of-missing-out.

They do not believe that fallout from a housing correction would be comparable to the 2007–09 crash in terms of size. They believe that household balance sheets appear to be in better shape. That, of course, could change as gas prices and food prices continue to increase much faster than wages.