1. National Real Estate Trends for 2025

As we approach 2025, many prospective buyers and sellers are asking, will real estate go down in 2025? While the answer depends on several factors, national trends suggest a complex but cautiously optimistic outlook for the housing market.

Stabilizing Mortgage Rates

One of the most significant influences on the real estate market is mortgage rates. After several years of volatility, experts predict a gradual decline in rates throughout 2025. This shift is expected to ease the “mortgage rate lock-in” effect, where homeowners with low-rate mortgages are hesitant to sell. As rates stabilize, more homeowners may be willing to list their properties, contributing to improved inventory levels.

Inventory Recovery

A notable trend in 2025 is the recovery of housing inventory. Builders are ramping up production to address the persistent housing deficit, with a focus on creating smaller, more affordable homes. Additionally, existing-home sellers are beginning to re-enter the market as conditions improve. However, inventory levels, while increasing, still trail pre-pandemic averages by approximately 20%.

Price and Sales Growth

On a national scale, home prices are expected to grow at a more moderate pace compared to recent years. Similarly, home sales are projected to edge slightly higher, signaling a more balanced market. These trends suggest that while the real estate market is unlikely to experience a dramatic downturn, regional variations will play a critical role in determining market activity.

2. Regional Highlights

When asking will real estate go down in 2025, it is crucial to consider regional dynamics, as trends vary significantly across the United States. While national forecasts suggest modest growth in home prices and sales, certain regions stand out for their resilience and potential for strong performance.

Southern and Western Markets Dominate

The South and West are poised to lead the housing market in 2025, with cities like Phoenix, Colorado Springs, Tucson, Boise, Las Vegas, Orlando, Odgen, and Tampa ranking among the top markets for growth. These regions benefit from several key factors:

- Affordability: Despite nationwide affordability challenges, these areas maintain relatively lower costs compared to other regions, attracting buyers from pricier metros.

- Demographic Strength: Younger populations, including families and military-connected households, are driving demand in these areas.

Flexible Work and Lower-Cost Markets Thrive

Markets like Miami, Atlanta, Buffalo, and Orlando are benefiting from the continued rise of remote and hybrid work arrangements. Buyers seeking affordability and flexible commuting options are drawn to these cities, which combine lower home prices with moderate proximity to larger economic hubs.

Sun Belt Cities Show Momentum

The Sun Belt continues to attract homebuyers, with cities like Phoenix and Las Vegas offering competitive advantages. McAllen boasts the highest share of outright homeownership among major metros, insulating it from high mortgage rates.

Regional Affordability Challenges

Despite strong performance in many Southern and Western markets, affordability remains a concern. Markets like Miami, for instance, require a higher share of income for home purchases, with a typical household allocating over 40% of income to housing costs.

3. Will Housing Prices Decline in 2025?

The question on many homebuyers’ and sellers’ minds is: will real estate go down in 2025? While nationwide home prices are expected to moderate, a significant decline in housing prices is unlikely based on current forecasts. Instead, the housing market appears to be stabilizing after years of volatility driven by the pandemic and rising mortgage rates.

National Price Trends

Home price growth is projected to slow further in 2025, making housing somewhat more accessible to buyers. However, instead of falling, prices are expected to hold steady or experience modest increases. Key factors preventing a significant decline include:

- Gradual Easing of Mortgage Rates: Lower rates are anticipated to encourage both buyers and sellers, supporting price stability.

- Persistent Inventory Challenges: Despite improvements, housing inventory remains below pre-pandemic levels, keeping upward pressure on prices in many markets.

- Strong Demand in Growing Regions: The South and West continue to attract buyers, sustaining demand and propping up prices in these areas.

Where Prices Might Soften

While most regions are expected to see stable or rising prices, certain areas could experience minor price adjustments:

- High-Crime Markets: More dangerous metros, such as Albuquerque, New Orleans, and San Francisco could see declines as people seek more safety and security.

- Less Recovered Markets: Areas that have not rebounded to pre-pandemic sales levels may face slower growth or marginal price decreases.

Government Programs and Housing Affordability

One factor mitigating a broader decline is the availability of government-backed mortgage programs like VA and FHA loans. These initiatives help first-time buyers and younger families access homeownership, maintaining demand even in markets where affordability remains tight.

New Construction’s Role

The increasing supply of new homes, particularly smaller, more affordable options, is helping to ease affordability pressures. This trend could slow price growth in certain areas where new construction is abundant, though it’s unlikely to lead to widespread price drops.

4. The Role of Government Policies in 2025

As we explore whether real estate will go down in 2025, it’s essential to consider the influence of government policies on the housing market. Policies related to mortgage lending, housing development, and affordability will play a significant role in shaping the trajectory of home prices and sales.

Government-Backed Mortgages and Housing Access

One of the most impactful government policies likely to influence the housing market in 2025 is the continued availability of government-backed mortgage programs. These initiatives, such as VA loans, FHA loans, and USDA loans, help make homeownership more accessible by lowering down payment requirements. In areas with a high share of military families or first-time buyers, these programs will keep demand strong, reducing the risk of significant price drops. In particular, government-backed loans are expected to be a major factor in preventing housing prices from declining too sharply, even as affordability challenges remain.

- VA Loans: With many military-connected households, cities like Colorado Springs and Virginia Beach benefit from increased VA loan usage, which lowers down payment requirements and helps sustain housing demand.

- FHA Loans: These loans are especially beneficial for younger buyers, allowing them to purchase homes with as little as 3.5% down. This type of financing is expected to remain prevalent in markets like El Paso and Richmond, where affordability and access to homeownership remain key concerns.

Government Policies on Housing Supply

While mortgage assistance programs are crucial, government policies addressing housing supply will also play a key role in shaping home prices. In 2025, federal and state efforts to alleviate the housing shortage, particularly in high-demand regions like the South and West, will be critical in determining whether prices stay stable or experience upward pressure. Government incentives for new construction, such as tax credits and grants for builders, could stimulate the creation of affordable homes, potentially easing inventory constraints.

Moreover, federal, state, and local governments will likely continue their efforts to streamline zoning and permitting processes to encourage more residential construction. In Colorado Springs and Phoenix, where demand for homes is high, these efforts may help fill the gap in housing inventory, providing more options for buyers and potentially reducing the upward pressure on home prices.

Affordable Housing Initiatives

In 2025, housing affordability will remain a significant challenge in many markets. To combat this, government policies aimed at increasing affordable housing availability—such as housing vouchers, affordable housing tax credits, and incentives for low-income housing construction—will help support lower-cost housing options. These policies could slow price growth in areas with strong demand by creating more affordable options, though they are unlikely to cause widespread declines in home prices.

Federal Reserve and Mortgage Rates

The Federal Reserve’s stance on interest rates will also be a key factor in determining whether real estate prices will decline in 2025. If the Fed continues to raise rates in response to inflation concerns, mortgage rates may stay elevated, limiting affordability and potentially dampening some buyer demand. However, should the Fed pivot to a more dovish stance, lowering interest rates, this could make mortgages more affordable and stimulate demand, keeping prices stable or even increasing them.

DOGE

Any attempt to reduce the size of government would reduce the deficit. A reduction in the deficit would result in a reduction of inflation. Inflation coupled with leverage is a real estate investor’s friend. Real estate investors profit from a combination of leveraged appreciation, cash flow, and tax benefits. If inflation decreases, appreciation also decreases. Thus, if Trump and Musk are successful in their DOGE plans, it could spell less profits for real estate investors. On the other hand, there is a limit to how much government spending can be reduced. Entitlements and interest make up a major part of the budget.

Immigration Policies

Large scale deportations, even if only of criminal illegal immigrants, could reduce demand for real estate. It could take a significant amount of time before such policies are implemented. Costs may turn out to become prohibitive. Increased enforcement measures at the border against informal crossings combined with some deportations could stem the flow of economic refugees.

On the other hand, a proposal to grant work visas to immigrant graduates of U.S. colleges could increase demand for real estate. Whether such policies will actually be enacted remains to be seen.

Government policies could significantly impact the 2025 housing market and help determine whether real estate will go down in 2025. Programs that make homeownership more accessible, along with initiatives aimed at increasing housing supply, will work against programs to increase affordability, with respect to home prices. As buyers and sellers navigate the market in 2025, understanding these government interventions will be crucial to making informed decisions and capitalizing on opportunities in a dynamic housing market.

5. Expert Forecasts on Housing Affordability

As we examine the question of whether real estate will go down in 2025, affordability remains a critical issue for many prospective buyers. Expert forecasts predict that affordability will continue to challenge homebuyers in 2025, but the extent of this challenge will vary based on location, market conditions, and government policies. Understanding expert predictions is essential to grasp how affordability will impact home prices and whether we can expect a downturn in the housing market.

- Experts’ Insight: Experts predict that the combination of still-high mortgage rates and limited income growth will contribute to the affordability crisis in 2025. These factors could suppress housing demand, particularly among first-time homebuyers or those with modest incomes.

According to Redfin, home prices will rise about 4% in 2025. Rising prices will prevent many Americans from getting on the property ladder. Many will rent instead. The also expect that loan rates will remain high, near 7%, for most of the year, for those who don’t prepay interest to buy down their rates.

Redfin predicts more home sales, as more inventory comes online. But that 2025 will overall be a renter’s market. It will cost less to rent than to own in many markets. They predict that reduced regulatory burden on new construction will lead to more home-building. An increase in inventory puts downward pressure on values unless population increases faster.

They also predict that people will pay less in commissions due to the recent settlement by the National Association of Realtors.

Redfin also expects that home prices will be pushed down (or appreciation will slow) in high risk areas like coastal Florida, wildfire-prone areas of California, and hurricane risk areas of Texas. They predict that flight from blue urban areas will decline as pro-business, tough on crime, mayors et elected in cities such as San Francisco and Portland. And they predict that Gen Z will be more interested in living with family or renting longer, and that lower priced homes will be purchased by older homeowners who are priced out of higher priced larger homes.

Zillow similarly forecasts a 2.6% home value growth in 2025, similar to 2024. They predict home sales activity to be up slightly to 4.3 million exiting homes from 4 million, approximately, in 2024. Affordability will continue to be a problem but there should be more inventory. They expect plenty of ups and downs throughout the year in terms of mortgage rates. They expect that there will be more buyers markets in the southwest as inventory continues to grow.

Current buyer’s markets, according to Zillow, include Louisville, KY, Nashville, TN, Memphis TN, San Antonio, TX, New Orleans, LA, Jacksonville, FL, Tampa FL, and Miami FL. Buyers have an edge in these cities due to high inventory, meaning that significant appreciation should not be expected in these cities. In fact, Zillow predicts a decrease in values in New Orleans and San Francisco for 2025.

The only strong seller’s market on their list is New York City. The list of buyer’s markets is likely to be joined by more southwestern cities in 2025, according to Zillow. This means that they expect weakness to spread.

Photo of Buffalo, NY by Jonathan Rivera on Unsplash, a possible hot market for 2025

Zillow is also predicting that more Americans will embrace small home living. They expect that renters will have fewer opportunities for rent concessions but that pet-friendliness will become non-negotiable as renters become older and more than half of renters have a pet.

A separate article by Zillow lists Buffalo as the USA’s hottest housing market for 2025. It has become a seller’s market and is attracting new residents due to low cost of housing and new jobs. Zillow’s report indicates that Buffalo has the most new jobs per new home permitted, which is a pretty interesting way to looking into the future for predicting appreciation. I wouldn’t want to have to deal with New York’s landlord-tenant laws and taxes, though. Other hot metros in Zillow’s list, besides Buffalo NY include Indianapolis, IN; Providence, RI; Hartford CT; Philadelphia, PA; St. Louis, MO; Charlotte, NC; Kansas City MO; Richmond VA; and Salt Lake City, UT.

The economists at the National Association of Realtors have a relatively good track record in their predictions for upcoming years. Their predictions for home price growth are much rosier than those of Zillow and Redfin.

The following is a table, sorted by appreciation rates they expect, of price growth predictions for the top major metro areas, according to NAR. It seems a little too optimistic to me, and I personally believe that Redfin and Zillow will be closer to the mark, but predictions are just that. There are no guarantees. Note that Zillow and NAR have different views on which cities are likely to be hot in 2025.

A single change in government policy can have an enormous impact on what lies ahead for real estate values. It is possible that we will see multiple unexpected changes.

| Metro Area | Appreciation Prediction (%) |

| Phoenix, AZ | 13.20% |

| Colorado Springs, CO | 12.70% |

| Tucson, AZ | 12.40% |

| Boise, ID | 12.30% |

| Las Vegas, NV | 12.30% |

| Orlando, FL | 12.10% |

| Ogden, UT | 11.80% |

| Tampa, FL | 11.80% |

| Daytona Beach, FL | 11.50% |

| Memphis, TN | 10.50% |

| Sarasota, FL | 10.40% |

| Winter Haven, FL | 10.30% |

| Atlanta, GA | 10.20% |

| Austin, TX | 10.20% |

| Durham, NC | 10.10% |

| Salt Lake City, UT | 10.00% |

| Jacksonville, FL | 9.80% |

| Stockton, CA | 9.80% |

| New Haven, CT | 9.70% |

| Fort Myers, FL | 9.60% |

| Melbourne, FL | 9.60% |

| Dallas, TX | 9.20% |

| Winston-Salem, NC | 9.20% |

| San Antonio, TX | 9.10% |

| Miami, FL | 9.00% |

| Raleigh, NC | 9.00% |

| Greenville, CA | 8.90% |

| Sacramento, CA | 8.90% |

| Riverside, CA | 8.80% |

| Spokane, WA | 8.70% |

| Buffalo, NY | 8.50% |

| Charlotte, SC | 8.40% |

| El Paso, TX | 8.40% |

| Knoxville, TN | 8.30% |

| Nashville, TN | 8.30% |

| Columbia, SC | 8.20% |

| Indianapolis, IN | 8.20% |

| Allentown, PA | 8.00% |

| Denver, CO | 8.00% |

| Oxnard, CA | 8.00% |

| Grand Rapids, MI | 7.70% |

| Greensboro-High Point, N.C. | 7.70% |

| San Francisco, CA | 7.50% |

| Cincinnati, OH | 7.30% |

| Houston, TX | 7.30% |

| San Diego, CA | 7.30% |

| Providence, RI | 7.20% |

| St. Louis, MO | 7.10% |

| Charleston, SC | 7.00% |

| McAllen, TX | 7.00% |

| Kansas City, KS | 6.90% |

| Seattle, WA | 6.90% |

| Rochester, NY | 6.80% |

| Springfield, MA | 6.80% |

| Honolulu, HI | 6.70% |

| Portland, OR | 6.70% |

| Syracuse, NY | 6.70% |

| Toledo, OH | 6.70% |

| Albany, NY | 6.60% |

| Oklahoma City, OK | 6.60% |

| Virginia Beach, VA | 6.60% |

| Tulsa, OK | 6.50% |

| Chattanooga, TN | 6.30% |

| Detroit, MI | 6.20% |

| Minneapolis, MN | 6.20% |

| Wichita, KS | 6.20% |

| Louisville, KY | 6.10% |

| Philadelphia, MD | 6.10% |

| Portland, ME | 6.10% |

| Richmond, VA | 6.10% |

| Bakersfield, CA | 6.00% |

| New Orleans, LA | 5.90% |

| New York City Metro, NY | 5.90% |

| Augusta, GA | 5.80% |

| Omaha, NE | 5.80% |

| Columbus, OH | 5.70% |

| Milwaukee, WI | 5.70% |

| Scranton, PA | 5.70% |

| Boston, MA | 5.60% |

| Hartford, CT | 5.60% |

| Los Angeles, CA | 5.50% |

| Madison, WA | 5.50% |

| Fresno, CA | 5.10% |

| Harrisburg, PA | 5.10% |

| Cleveland, OH | 5.00% |

| Washington, DC | 5.00% |

| Stamford, CT | 4.90% |

| Des Moines, IA | 4.90% |

| Lansing, MI | 4.90% |

| Little Rock, AK | 4.80% |

| Pittsburgh, PA | 4.70% |

| Chicagoland, IL | 4.50% |

| Dayton, OH | 4.30% |

| Akron, OH | 4.20% |

| San Jose, CA | 4.00% |

| Baltimore, MD | 2.70% |

| Baton Rouge, LA | 2.70% |

| Birmingham, AL | 2.30% |

| Albuquerque, NM | -4.20% |

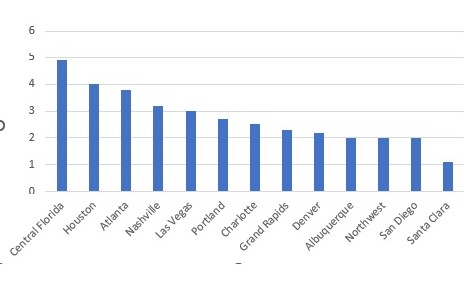

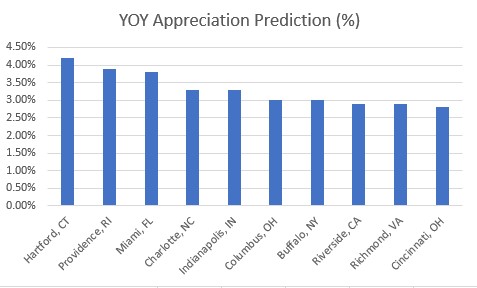

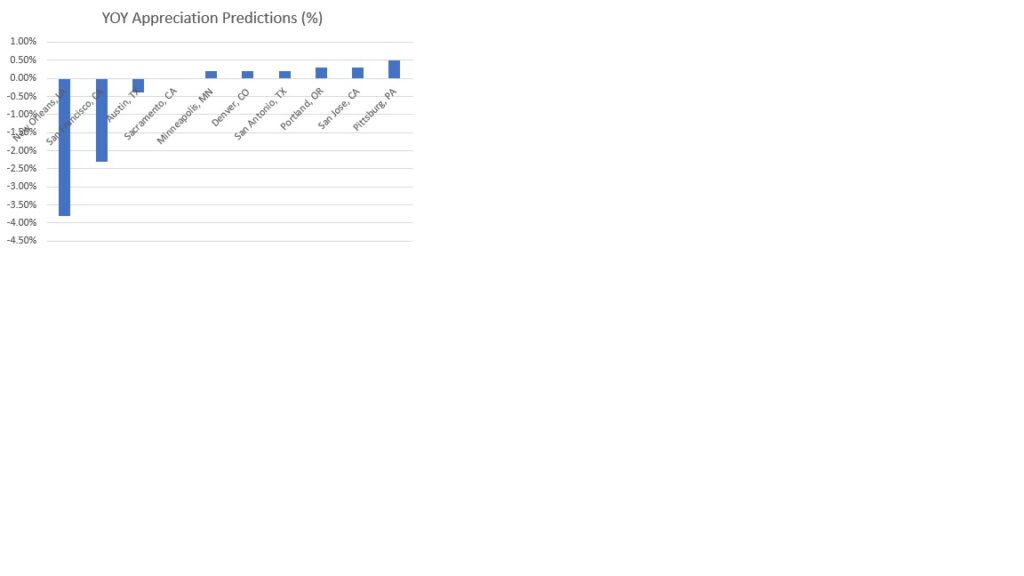

Summarizing the Realtor information yields a very different Infographic from the one generated from Zillow predictions:

I personally find the Zillow predictions to be more believable than the Realtor predictions for 2025. The Realtor predictions seem incredibly optimistic considering the low cap rate, high interest rate environment that we are in.

Another expert worth hearing out is Bill McBride, who correctly called the last real estate crash based on his interpretation of inventory data. His view is that high inventory is predictive of a crash more than anything else. His latest inventory data shows Florida and Texas as having high inventory. This also puts into question the Realtor predictions.

Supply and Demand Impact on Affordability

While affordability remains a challenge, experts also anticipate that improving housing inventory could alleviate some of the pressure on prices.

New Construction Trends: Experts note that homebuilders are focusing on constructing more affordable homes, particularly smaller single-family homes. This strategy will help meet demand and improve affordability in some markets. Yet, despite these efforts, rising construction costs and limited land availability may still push home prices higher in certain high-demand areas.

Government Policies and Affordability Solutions

Additionally, experts believe that affordable housing initiatives—such as tax credits for low-income housing construction and housing voucher programs—will help maintain a balance between demand and supply, preventing drastic price declines while helping those most affected by affordability issues.

Price Stabilization or Decline?

Despite the affordability challenges, experts predict that home prices are unlikely to decline sharply in 2025. The combination of ongoing demand, government policies, and a gradual improvement in inventory will likely lead to a more balanced market rather than a significant downturn. However, there are still certain areas where price growth may slow, especially if demand wanes due to affordability limits or if mortgage rates remain elevated.

- Forecasts: Expert forecasts suggest that affordable markets will see more moderate price growth, offering opportunities for buyers who are priced out of more expensive areas. In these markets, experts predict that home prices may even stabilize or experience small declines, as affordability improves due to lower demand or increased supply.

6. Key Takeaways for Buyers and Sellers in 2025

As 2025 approaches, prospective buyers and sellers in the real estate market must prepare for a landscape shaped by various economic, policy, and market forces. With the question of whether real estate will go down in 2025 lingering in the minds of many, understanding key takeaways for both buyers and sellers can help navigate the housing market with confidence. Below, we break down the most important trends and insights buyers and sellers should be aware of in 2025.

For Buyers: What You Need to Know in 2025

- Affordability Will Remain a Challenge

One of the biggest takeaways for buyers in 2025 is that affordability will continue to be a challenge in many markets, particularly in the South and West regions. While there may be slight improvements in inventory levels, prices will remain elevated due to sustained demand and limited housing stock. Buyers will need to be prepared for higher-than-average appreciation, in addition to high prices, especially in cities like Miami, Phoenix, Salt Lake City, Colorado Spring, and Fort Meyers.- What This Means for Buyers: Buyers should be ready to allocate a higher share of their income towards homeownership. In some markets, this could mean that the typical buyer will spend more than 30% of their income on housing, which is above the national average.

- Increasing Inventory Could Provide More Opportunities

While affordability may be strained, there is hope for buyers as housing inventory continues to recover. With builders ramping up construction and new homes coming to market, buyers will have more options to choose from, especially in areas where new construction is most active.- What This Means for Buyers: The increase in housing supply could lead to more balanced market conditions, offering buyers a better selection of properties. However, these improvements in inventory won’t necessarily lead to significant price declines. The focus for buyers should be on areas with increased new construction and higher affordability.

For Sellers: What You Need to Know in 2025

- Inventory Recovery Will Be a Double-Edged Sword

For sellers, the recovery of housing inventory presents both opportunities and challenges. As more homes come to market, buyers will have a wider range of options, which could dampen price growth in certain regions. However, sellers in areas with limited housing stock will continue to benefit from strong demand and higher prices.- What This Means for Sellers: Sellers in high-demand areas will likely see strong interest in their properties. However, sellers in markets where inventory is rising more quickly (Florida and Texas) may need to price competitively to attract buyers.

- New Construction Will Offer Sellers More Competition

As builders increase new home construction, sellers of existing homes may face increased competition, particularly in markets where new properties are priced more competitively. Single-family home construction is expected to rise in key markets, and this may affect sellers of older homes as buyers have more choices.- What This Means for Sellers: Sellers should be prepared for potential competition from new builds, which may offer buyers modern features and lower maintenance costs. To stand out, sellers will need to highlight the unique value of their property, such as location, upgrades, and neighborhood amenities.

- Interest Rates and Mortgage Lock-In Effect Will Impact Timing

For sellers, timing the market will be critical. The ongoing mortgage lock-in effect—where homeowners hesitate to sell due to their current low mortgage rates—will continue to influence market dynamics. If interest rates remain elevated in 2025, many homeowners will be reluctant to sell, limiting available inventory in certain regions and helping to maintain higher prices in the short term.- What This Means for Sellers: Sellers who are able to navigate higher mortgage rates may benefit from the limited supply of homes for sale. However, those who wait to sell until rates drop could see more competition as more homeowners decide to list their homes.

Key Takeaways

- Real Estate Prices May Not Decline Significantly: While some markets may see slower growth or price stabilization, experts predict that overall, real estate prices will not drop drastically in 2025. The combination of demand, government policies, and rising inventory will likely keep the market relatively balanced.

- Buyers Should Act Strategically: Buyers should consider government-backed loan programs to ease the affordability challenge and focus on areas with rising inventory. Buyers should also be prepared to face elevated home prices in high-demand areas.

- Sellers Will See Strong Demand in Certain Markets: Sellers in markets with limited inventory and strong buyer demand will likely see favorable conditions in 2025. However, they should be mindful of the competition posed by new home construction in some regions.

- Timing Is Key for Both Buyers and Sellers: Both buyers and sellers will need to carefully consider interest rates, inventory levels, and the timing of their decisions. Sellers should act quickly in high-demand markets, while buyers may benefit from waiting for more inventory to come online.

By staying informed about these key trends, both buyers and sellers can make better decisions and position themselves effectively for the 2025 housing market.

Conclusion

So, will real estate go down in 2025? While certain markets may experience slight declines, the broader picture points to a steady or slightly appreciating market. Factors like improving mortgage rates, strong regional demand, and limited inventory suggest that a significant nationwide downturn in housing prices is improbable. Buyers and sellers should focus on regional dynamics to make informed decisions in this evolving market.

As experts weigh in on the question of whether real estate will go down in 2025, it’s clear that affordability will remain a central issue for buyers. While the overall housing market may not experience a drastic decline, affordability concerns could keep prices in check in certain regions. The balance between housing demand, government policies, and the pace of new construction will ultimately determine how prices evolve in 2025. Buyers will need to consider these expert forecasts when navigating the market to understand whether they can expect prices to stabilize, grow, or decline in specific areas.

The above graphic shows Zillow’s predicted hot markets for 2025. The graphic below shows Zillow’s predicted weak markets for 2025.

You will have to make your own decisions as to who to believe. You can supplement your research using Local Market Monitor, local real estate agents and property managers, and by considering rental yields or, better yet, cap rates.