Understanding the APOD for Real Estate | BuyGEG

One of the first things you should learn as an investor is how to calculate “cap rate” (capitalization rate). This is the rate of return from rent for the first year of ownership, if you paid all cash, assuming zero appreciation. But what if you want to see a longer term picture; i.e., the benefits of holding a rental real estate property over many years? And also want to see the tax benefits?

An APOD (Annual Property Operating Data) worksheet provides a detailed analysis that also takes into consideration appreciation and tax benefits over multiple years. It is a document that members of the CCIM Institute can access and fill in to provide a detailed financial analysis of a rental property. CCIM stands for Certified Commercial Investment Member. A few real estate agents earn the CCIM designation after taking courses, showing a certain number or amount of sales, and paying annual dues.

An example of a five year APOD can be found here: http://www.garytharp.com/forms/

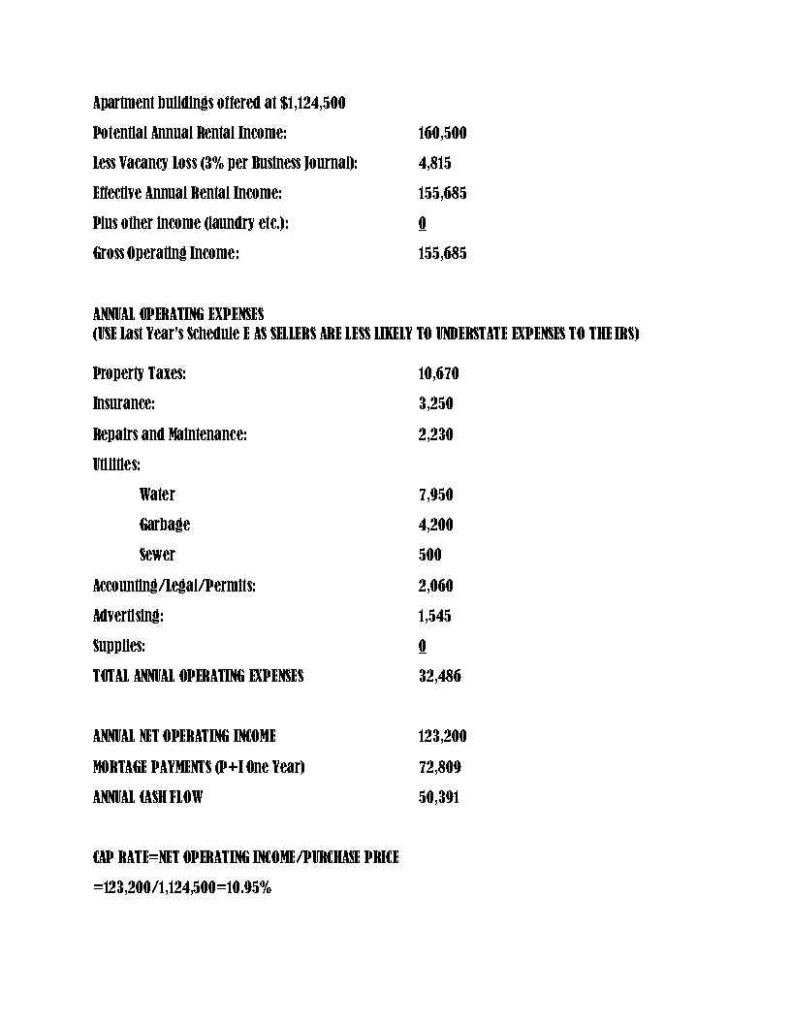

An APOD spreadsheet from CCIM has multiple pages. On the first page of the APOD, inputs include purchase price, loan balance(s), annual debt service, potential rental income, expected vacancy losses, real estate taxes, management fees, repairs and maintenance, utilities, and other expenses. The outputs are Net Operating Income and Cash Flow Before Taxes. This is information for the first year. It is not much different from a cap rate analysis but shows cash flow after both principal and interest.

The second sheet of the APOD is similar to the first one but shows income and expenses over multiple years. It also shows cash flow after taxes. To obtain these calculations, some assumptions are required. On an “Assumptions” tab, inputs include Ordinary Income Tax Bracket, Capital Gains Max Tax Rate, Tax Rate on Straight Line Recapture, Vacancy Rates for each year, Income Escalators for each year, and Expense Escalators for each year. Predicting how income and expenses will change over each year can be tricky. It is probably best to be more conservative on Income Escalators than Expense Escalators. This is particularly true if you are the type of landlord who is slow to raise rents on good tenants. Meanwhile, the government overspends and the Fed prints money, causing inflation. Whatever inflation rate you are expecting is a reasonable number to put into the Expense Escalators on the Assumptions tab of the APOD. The Fed has a target of 2% but is having trouble getting there. 3% is probably a better assumption than 2%, at least for 2025.

The third sheet of the APOD shows a calculation of sales proceeds based on what Cap Rate buyers are requiring. For single family homes, buyers don’t typically consider cap rates. For multifamily homes, the cap rate a buyer will want usually varies depending on what kind of rates of return are available from other investments, such as CDs, but also varies depending on how much they are willing to gamble on future appreciation (most are gamblers to some extent). This page of the APOD lets you see likely sales prices at different cap rates. The cap rates projected for your building will vary depending on the rent escalator that you are projecting. The actual rents you charge in the future will have a significant affect on your future valuation.

As with all information provided to induce you to buy, an APOD presented to you by a real estate agent should be taken with a grain of salt. Make sure that rents shown on the APOD analysis match current actual rents and are not “pro forma” rents. Also make sure that predicted appreciation matches your expectations of appreciation. If you download and play with an APOD spreadsheet, you’ll see that adjusting the predicted appreciation rate will have a large impact on predictions. Nobody knows for sure what future appreciation will be, so these numbers are largely speculative.

Make sure you use an appreciation rate that seems reasonable to you. If someone tells you that because last year’s appreciation rate was x percent, it is reasonable to assume that appreciation will be x percent next year, ask them if that was also true in 2007. It is more reasonable to use a predicted inflation rate or average appreciation rate. Use zero for one of your APOD calculations so you can see if you will have positive cash flow if there is zero appreciation. If you have positive or zero cash flow without appreciation, you can wait out down cycles.

Sample Page 1 of APOD: