I am pleased to have been featured in the September 2024 edition of Fortune Magazine. I was interviewed about my investments in Mexico, France, and Grand Cayman. The article briefly touched on some of the headaches I encountered in Mexico. This article presents a more in-depth discussion of risks that Americans face when buying Mexican real estate.

Considering buying real estate in Mexico? Let me try to talk you out of it. If you still want to proceed, after reading this article, and you are looking at Cabo San Lucas, San Jose del Cabo, or the corridor inbetween, let me at least hook you up with my attorney, accountant, and real estate agent. They have been very good to me.

1. The Legal Essentials Of Buying Property In Mexico As A Foreigner

Purchasing real estate in Mexico can be a fantastic opportunity for foreigners, but understanding the legal landscape is crucial to making a successful investment. Advantages of Mexico include 1. airports in desirable locations (no need to transfer from the international airport to get to the beach as is the case in other countries such as Costa Rica and Panama); 2. proximity to the U.S. for U.S. health care or to visit friends and family; 3. possibility to avoid entering the Mexican tax system if all your income is from the U.S. and you maintain a home in the U.S. (seek out professional advice from an accountant to discuss the nuances of this). Here’s a breakdown of key legal essentials to consider:

1.1 Understanding Foreign Ownership Rules

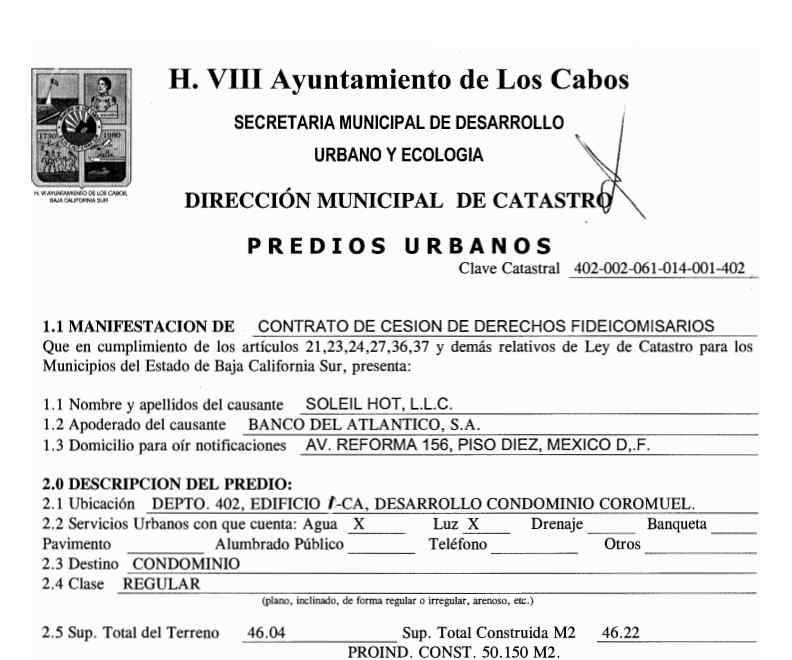

- In Mexico, foreigners can legally own property almost anywhere in the country, but there are restrictions within the restricted zone (50 kilometers from coastlines and 100 kilometers from borders). Foreign buyers can still purchase property in these areas, but they must do so through a fideicomiso (bank trust) or a Mexican corporation.

1.2 Fideicomiso: The Bank Trust Solution

- A fideicomiso is a legal arrangement that allows foreign buyers to acquire property within restricted zones. In this setup, a Mexican bank holds the title of the property in trust on behalf of the foreign buyer, who retains all rights to use, sell, lease, or pass the property to heirs.

- The fideicomiso lasts for 50 years (unless you take over the seller’s existing fideicomiso, in which case you get however many years are left) and is renewable. The foreign buyer generally has full control over the property, just as a traditional owner would, with whatever restrictions are contractually agreed with the bank in the contract.

1.3 Using A Mexican Corporation

- For those interested in purchasing commercial property or multiple properties, forming a Mexican corporation is an alternative. This can be especially useful for buyers looking to operate a business or manage rental properties.

- A corporation in Mexico can be owned 100% by foreigners, requires two shareholders, and does not require a fideicomiso, even if the property is within the restricted zone.

- There is legal ambiguity over whether a Mexican Corporation can own residential real estate. Ask your lawyer. Also ask about the U.S. and Mexican tax consequences. Properties owned by Corporations may face much higher utility rates.

1.4 Title Insurance

- Title insurance isn’t part of the standard purchase process in Mexico but is a valuable safeguard and should be demanded, in your offer, to ensure that there are no prior claims or unresolved issues related to property ownership. This insurance protects buyers against unexpected legal disputes over the title, giving peace of mind in a foreign country. U.S. buyers should consider using a U.S. title insurance company to increase the odds of recovery in case of a title problem.

1.5 Closing Process And Notary Requirements

- In Mexico, all real estate transactions must be finalized before a Mexican notary public to be legally binding. The notary verifies the property’s legal status, ensures taxes are paid, and drafts the official purchase contract. This process is crucial for securing a legitimate title.

- Closing costs in Mexico are much higher than the U.S. and generally range between 4% and 7% of the property’s purchase price and include notary fees, registration fees, and property taxes.

1.6 Taxes And Ongoing Obligations

- Foreign buyers should be aware of annual property taxes (predial), which are generally lower than in many other countries. Additionally, if selling the property, there may be significant capital gains taxes to consider, though certain exemptions and deductions may apply. Be aware of currency risk. If the peso goes down relative to the dollar, you will have capital gains, and therefore capital gains taxes, even if you break even on the sale in U.S. dollar terms. To be able to deduct for expenses, you will typically need a “factura” which is different from a receipt. Many contractors do not like to give facturas because doing so obligates them to pay income taxes. To get a factura for a purchase, e.g., an appliance purchase, you usually need to ask for one and to pay an extra fee for one. There can be a capital gains exemption for the sale of your primary residence, if you have permanent residence status, but the Notario has liability if they give it by mistake so they do not like giving this exemption. Ask your real estate agent if they have had success obtaining this exemption and make sure, in a sale contract, to use a Notario who has given this exemption. Different Notarios will have different documentation requirements, such as your tax ID on power bills, your power bill address exactly matching the address in your fideicomiso, bank statements with your tax ID and address on them, etc. Be aware that you may need to pay a higher utility rate if you have your tax ID on your power bills. If your title is in a corporation, you may not be able to obtain this exemption for a primary residence. Mexico is full of contradictions and traps and you may not realize you have made a mistake in how you have conducted your affairs until you try to sell your property.

- For those planning to rent out the property, understanding local rental laws and tax obligations is also important. You will have monthly declarations and taxes to pay, in addition to an annual declaration. A significant value added tax needs to be paid on furnished rentals. DIOT (Declaration of Operations with Third Parties) declarations should be filed monthly to report payments to third parties like contractors and other purchase transactions. Mexican income taxes on rental properties can be significantly higher than U.S. taxes on U.S. rental properties. If you are going to rent out your property, you should expect to have accountant expenses. You will also need a tax ID number and a “FIEL.” A FIEL a set of files issued under the SAT’s (Mexican tax authority) infrastructure that, when used in conjunction, allow to generate advanced (qualified) electronic signatures. It is obtained from the SAT tax authority (Mexican IRS) by appointment only. Once issued, it is valid for four years.

1.7 Working With A Real Estate Lawyer

- While not mandatory, hiring a real estate lawyer with experience in Mexican real estate law is strongly recommended for navigating complex legal requirements, ensuring all paperwork is in order, and handling any unexpected legal issues. You may want to hire one before even talking to a real estate agent. You want one who clearly works for you, not one that depends on a real estate agent for business. You may want to use attorney drafted forms, not real estate agent forms that mostly protect their commission.

2. How Americans can Reduce Risk When Buying Real Estate in Mexico

2.1 Avoid Ejidos

Stay away from privatized Ejido land (communal farming land). In case of any dispute, the agrarian judge always rules in favor of the Ejido. Ejidos may try to sell land that they are not allowed to sell, then claim it back if it has appreciated or been built upon. For example, the Mexican Supreme Court ordered the eviction of about 200 Americans from their properties in Baja California’s Punta Banda region. This decision concludes a 27-year land dispute involving communal land known as ejidos. Despite American residents following legal procedures, they faced eviction as the ejido, Ejido Coronel Esteban Cantu, was embroiled in an unresolved ownership issue. The Agrarian Reform Ministry has committed to enforcing the evictions. Affected residents, some retirees, suffered significant losses as they have invested heavily in their homes. Some retirees put their life savings into their homes. Attempts to negotiate with the landowners have largely failed. In the Puenta Banda story in Ensenada, there were rumors of corruption and maps being redrawn. The dispute highlights the risks: Mexican courts and land records can be murky, and legal battles are often prolonged. The U.S. government has warned citizens of these challenges.

I contacted an owner in one of the complexes I was considering before I bought my first condo in Mexico. She told me that she loved her condo. She bought her condo years earlier but still didn’t have her Fideicomiso. There were liens on her title that she couldn’t figure out how to remove. She told me that the purchase contract could be a promise to sell all in Spanish and the buyer will never know they are getting a property with a title problem. She told me to be careful about buying in her complex, because many units had liens on them. I was glad I had contacted an owner.

2.2 Don’t Trust Real Estate Agents With Funds

I once sent a friend to investigate properties in Cabo San Lucas. He was to meet a real estate agent named Lulu Jacobsen (Luetta Jacobsen). She was an American living in Los Cabos and selling real estate there at Manana Today Realty, a Coldwell Banker franchisee. When my friend arrived in Los Cabos, Lulu was not available, she had some legal issues in the States, my friend was told. But another agent greeted him and showed him around. He met with an escrow agent to discuss risks of buying real estate in Mexico and how to avoid them. She advised him to stay away from Ejido lands, and that was pretty much the only risk she raised. The agent showed my friend several properties.

When my friend came back and I read some things about Lulu. It is alleged that she emptied her trust account and fled to the U.S. with all the money. Mexican real estate “trust accounts” are not insured. Earnest money payments are often 10% of the purchase price (compared to 1% in the U.S.) and those funds are used to clear liens. If you send a 10% down payment to a real estate agent, the agent could combine money from multiple transactions and disappear and you’d have little recourse. Hiring a private investigator to find someone who has stolen money from you, getting a judgment (or judgments in two countries), and finding assets can easily cost more than the down payment you lost so, for many, there is little point pursuing them. Even if the real estate company is a U.S. name franchise, like Coldwell Banker in the Lulu story, they may claim that it is a different legal entity in Mexico. The boxer Oscar de La Hoya apparently lost money in this manner and tried to make the case that Coldwell Banker and other defendants should have some responsibility because they knew that Lulu Jacobsen had mishandled client funds in the past. Coldwell Banker of Mexico is not Coldwell Banker of the U.S. A U.S. name doesn’t mean as much as you might think it does.

2.3 Beware Of Prevalent Title Flaws

Ask the sellers if they have U.S. title insurance and if they have their Fideicomiso. If a non-Mexican seller of a property in an area where Fideicomisos are used doesn’t have their Fideicomiso, there is a reason why, usually some title problem. That doesn’t stop the sellers and agents from selling you something. If the seller has a Fideicomiso, that is not a guarantee that they have clean title. Be sure to hire an attorney.

Unlike the standard process in the U.S., title insurance is not automatically obtained in the Mexican closing process unless you ask for it. Title insurance issued by a U.S. company is enforceable in U.S. courts if issued by a company incorporate in the U.S. (this does not apply to Mexican-incorporated title insurance companies with familiar U.S. trademarks). Make sure that U.S. title insurance is listed in your closing cost estimate from the closing agent.

Be aware that the notario publico typically only examines the current deed and a current lien certificate, which results in the possibility of an incomplete search of title history. Make sure the title insurance can be enforced in the U.S., some policies are Mexican policies.

2.4 Asking For Title Insurance Is Not Enough

Even if you ask for title insurance in your offer form, and pay for it, you might not ever receive a policy. Title insurance is sometimes only ordered until after funds are disbursed, unless you instruct your closing agent otherwise. Don’t use the real estate agent’s offer form. Have your attorney draft the offer and insist that your attorney review the commitment for title insurance before any funds get disbursed. Read the exclusions in the commitment for title insurance carefully yourself before funds get disbursed, not after your funds are disbursed. Make sure you can live with the exclusions–there may be more exclusions than in a typical U.S. title insurance policy. The escrow agents get recommended by the real estate agents, and the real estate agents have every incentive to make sure your cash gets disbursed. Ask (or have your attorney ask) the seller for their escritura publica (public deed), certificado de libertad de gravamen (certificate of no liens), and consider also asking for a certificado de no aduedo (certificate of no tax due) from the local taxing authority to make sure the seller has authority to sell and has no liens on the property. Property taxes are relatively low so property tax is a relatively minor concern, though one that should be investigated. The buyer’s position should be that no funds get disbursed until buyer’s attorney is satisfied that liens can be removed and that the seller has the legal ability to sell. My experience has been that the closing agent will ask you to sign a document authorizing them to disburse funds well before a title report has been prepared, and well before you really should authorize disbursement of funds–don’t be in a rush to sign this, it will not speed up the process.

2.5 Understand Mexican Labor Laws

There is a reason why you see many uncompleted buildings Mexico. The labor unions are strong and can strike and place liens on buildings. To remove the lien, my understanding is that you have to pay back-pay as if the workers were working the whole time. Liens can be expensive to remove. It is better to get clean title than to have to try to fix title.

2.6 Don’t Trust Escrow Agents With Funds

Escrow agents in Mexico don’t necessarily use insured bank accounts. They could empty out their escrow account and flee. This has happened to me. After I had wired the full purchase price plus closing costs to a U.S. bank account of an escrow agent named America Alvarez, one of the most prominent escrow agents in Los Cabos at the time, she transferred money from her U.S. escrow account to a bank account in Mexico, grabbed the money, and disappeared. I didn’t realize this until later, but America Alvarez used to work for Lulu and apparently learned from her. Not much happened to Lulu after she fled. This obviously left several people in a very bad way. Several buyers and sellers whose transactions were in process had no idea whether the buyer or seller should absorb the loss. Some flew to Los Cabos right away to file complaints. Lawyers and private investigators were offering their services (for large fees). I contacted the U.S. embassy in Los Cabos and got no response. I contacted a property manager who also sells real estate, and his reaction was, just when sales were getting better after the Lulu Jacobsen disaster, this had to happen. There was far more concern about potential loss of sales then any interest in making the victims whole or spending any money in filing complaints. The local AMPI did not feel it was their business to help or take any action against agents who exposed their clients to such risk. Only the Gringo Gazette had the courage to break the story, even though a large percentage of advertising revenue came from real estate sales. I contacted the FBI, the San Diego county district attorney, and others. I filed a complaint in Mexico. I filed a civil suit in California. Many people lost money. Some people lost their live savings. It made no difference whether or not they used big name U.S. franchise or AMPI (local MLS) member. I also learned that you have to pay money to a prosecutor to get them to investigate a complaint. I was told by a Mexican attorney that the Mexican prosecutors will not prosecute unless a case is either very high profile or victims pay them to help investigate.

One Mexican lawyer told me that if anything is going to happen against the perpetrators, it will happen in the U.S., not in Mexico. The U.S. FBI is more interested in terrorists than thieves.

So if you can’t even trust the escrow agent, how do you fund the purchase? Use U.S. escrow. If you don’t follow any other advice here, one of the most important recommendations of this article is to use U.S. escrow. Fidelity Title in New York and Stewart Title in Houston provide this service for Mexican transactions. Their fees are negligible compared to the risk, and the value of this service is very high. More and more developers and agents in Mexico are suggesting U.S. escrow. If your agent does not, perhaps you should get another agent. Insist on U.S. escrow.

2.7 Get Multiple Quote For Closing Costs

Transaction costs are huge. There is a big transfer tax. Expect to pay about 7% of the property value in closing costs, which include notario fees, taxes, registration fees, foreign investment permit, and other fees. And don’t expect to get that back when you sell. Only buy if you are planning to hold long term or to flip before closing. Closing costs include acquisition or transfer tax (this is a big one, and is a percentage of transfer price), fees for an appraisal, for a permit from the ministry of foreign affairs, for a foreign investment commission recording fee, notary fees, and closing agent fees.

Get multiple estimates for closing costs and decide for yourself which closing agent to use. Factor in closing costs when predicting your rate of return. And ask your closing agent to compare fees from different fiduciary banks. Compare closing agents and fiduciary banks. Ask for recommendations from past clients to determine how efficient the closing agent is. If the closing agent has big accounts (big condo projects for which they are the exclusive closing agent), your tiny closing may take lower priority. There are multiple steps that still have to occur to complete your closing after your real estate agent gets paid commission. After the commission is disbursed, the pressure is off. Choosing a good closing agent is important. You can use an attorney as a closing agent if you so choose.

2.8 Be Aware That Different Notarios Make Different Calculations

Closings in Mexico are handled by Notorios. A Notario in Mexico is much more than the equivalent of a U.S. notary public. Instead, a Notario is an attorney and is a neutral government lawyer involved in real estate closings. Among other things, the Notario is responsible for formalization of the final real estate contract, collection of transfer and capital gains and recordation of the transfer with the Public Registry. The Notario is not your lawyer. They perform a title search but only go back one or two transactions. Different Notarios can make different calculations in terms of capital gains tax that the seller has to pay. Don’t be intimidated into accepting a Notario that makes a lower tax calculation for the seller than your attorney thinks it should be. Lower capital gains tax for the seller may mean eventual higher capital gains tax for the buyer, when you eventually sell. You may not realize that capital gains taxes have been shifted to you from the seller until you sell. Although Notario fees are typically fixed, it may be possible that different Notarios will charge different fees. Ask your attorney to verify the Notario’s calculations. Consider getting a second opinion. I have found the Notarios to be honest and competent, and have not had any trouble in this regard except that I was once asked to use a Notario whose calculation resulted in a lower tax calculation for the seller than another Notario.

2.9 Be Aware That If The Seller Doesn’t Pay Capital Gains Tax, It Usually Gets Shifted To The Buyer

People used to underreport values because of the high transfer tax. Sellers would pay less capital gains tax, buyer would pay less transfer tax. But the government has caught on. If you do this, or allow the seller to do this, you will get stiffed with the seller’s capital gains. If the seller doesn’t pay their capital gains, for any reason, the buyer will probably eventually have to pay it. For example, if you underreport your transfer value when you buy, you will pay increased capital gains tax when you sell. Ask your lawyer if you can modify the offer to say that the seller doesn’t get any money until they pay their capital gains taxes. Watch out for properties with title in a LLC or corporation (offshore or domestic). There is a good chance you will get stuck paying the seller’s capital gain taxes if you just buy shares of the company. You might not even realize what happened until you sell. On the other hand, if you receive a discount corresponding to the additional capital gains taxes you will be responsible for, it may be worth buying the shares of the company as this will result in a much quicker closing than with the normal process. If it is an offshore corporation, that brings into question the seller’s ethics–they may have been trying to avoid income taxes. Even if your offer says that capital gains taxes are to be paid by seller, this doesn’t completely protect you. This is where an attorney can help. Make sure your attorney verifies that the capital gains taxes have been resolved before funds are disbursed to the seller.

2.10 Avoid Misunderstandings About Recorded Transfer Price

Because you don’t want to get stuck with extra capital gains tax, make sure your seller, attorney, and closing agent understand that actual purchase price is to be recorded, not some reduced number. Or you may be in for a rude awakening when you sell your property.

2.11 Talk To The HOA Manager And Other Owners

You have to bargain hard on purchase price. Asking price is not necessarily close to true market value. Asking price could be double true market value. There are MLS “sold” books but agents typically do not report any data. Many agents will have no idea what other units have sold for. Besides, just like in the U.S., their commission would be higher if you paid more. A big problem I had was that I wanted to be sure I wasn’t overpaying. To get a sense of true market value, consider searching public records. You can hire an escrow agent to search public records to determine past transfer prices for neighboring properties as well as to determine what your seller paid. This is not cheap but will get you more information than most buyers have. You will have to convert pesos into dollars using the exchange rate in place at the time. You can find historical exchange rates at www.xe.com But be aware that many values are underreported, so some of the data from the public records may not be valid. HOA managers have a good sense of recent activity and prices. You can contact other U.S. owners and ask them what they paid. I’ve found most to be extremely candid. Ask them if they would buy again in this complex. You may learn about legal problems, high condo fees, poor condo association management, theft of association funds, expected high special assessments due to storm damage or maintenance needs, etc. Or you may learn that the complex you are considering is a great place to be with involved owners and competent condo association management.

2.12 Be Aware That Originals Are Important

Make sure you get original, signed, versions of important documents. Unless things have changed, courts will throw you out if you only have faxed copies of documents. This is in contrast to the U.S. where even an email or text message can be evidence of a contract and where common sense prevails over formalities. Get and keep originals or at least certified copies as your attorney advises. Documents signed in the U.S. need to be notarized and sent to the Secretary of State for an Apostille.

2.13 Be Aware Of Squatters’ Rights

Be aware that Mexican law recognizes squatters’ rights. There are professional squatters that move into the path of development hoping for a payoff. Developers sometimes hire guards to live on vacant land to keep squatters away. You certainly want to fence any vacant property. Think twice about buying vacant land. Learn about squatters’ rights, and take steps to prevent squatters from occupying vacant land if you do decide to buy vacant land.

2.14 Understand Fideicomisos

As discussed above, foreigners who buy property near the coast or border in Mexico cannot hold title directly. They must hold title in a bank trust, called a Fideicomiso. A bank holds title, and you have beneficial rights. You can sell and have most of the rights of a regular owner, but must pay the bank a fee every year. And if you ever invoke your home government to try to separate from Mexico, as they did in Texas in the days of the U.S.-Mexican War, you lose title. If you obtain Mexican citizenship or buy in the interior of Mexico (e.g., Mexico City), you can hold title directly. There is an annual fee for the services of the trustee. The amount of the fee is set in your trust documents so make sure your closing agent shops around. Banks may increase the fees over time even though the trust document specifies certain fees. After recording, be sure to get the number of your fideicomiso. Also ask where and how the bank fees need to be paid each year.

2.15 Closing Process

It takes at least 2 months to get possession and 4-12 months before you get your actual Trust. Registering property in Baja California Sur requires seven procedures, about 123 days, and costs 3% of the value of the property, on average. Decide in advance how to hold title. Because the process takes so much time, and there are transfer taxes and expensive closing costs, decide carefully how you are going to hold title

2.16 Understand When Mexican Corporations Can Be Used

Some people put title in corporations to avoid the bank fee. A foreigner can set up a Mexican corporation. You only need two shareholders and one can be a U.S. LLC. There is ambiguity in the law as to whether you can own residential real estate in a Mexican corporation if you don’t live in it. I have received different answers from different people. My understanding is that you cannot own residential real estate in a Mexican corporation if you plan to live in it. The Mexican tax authorities watch you more carefully if you have a corporation, according to my accountant. The rates for utilities such as power are typically higher for corporations than individuals.

2.17 Understand Mexican Taxes

If you rent out your property or make capital improvements, you need official “Facturas” if you are going to take deductions. You need to take itemized deductions if you use a Mexican company to hold title to your property). If you pay Mexican tax as an individual, there is a blind deduction option to paying income tax, which is the easiest approach. You need to get a Mexican tax ID or the renter is supposed to withhold the tax for you and submit it to the government, which is not likely to happen. To get a Mexican tax ID, you have to claim you are a Mexican resident. Depending on your activities in Mexico and length of stay, you may become a resident of Mexico for tax purposes. My understanding is that if you stay 183 days in Mexico and your center of economic activities are in Mexico, you are a Mexican resident for tax purposes and subject to Mexican income tax on your worldwide income. Be sure to speak to a Mexican accountant if you don’t want to become a Mexican resident for tax purposes. Mexican taxes can be quite a bit higher for rental properties than U.S. taxes. You can end up paying Mexican taxes even if you have a net loss. If you have multiple U.S. rental properties, you probably don’t want to become a Mexican tax resident subject to tax on worldwide income.

Government officials have shown up at condo association meetings for one of my condos and have demanded lists of owners who rent out their unit. Their position was that these people need to pay income tax, needed proper visas, and needed to modify their Fideicomisos to allow rental activity. It is rumored that the hotels don’t like untaxed competition from condo owners and lobbied for greater enforcement of the rules against American condo owners. Shakedowns are not unheard of. If you do have income in Mexico, you are supposed to pay estimated taxes every month. Be prepared to get lousy information from your property manager with respect to income and expenses. Don’t expect anyone to give you receipts for anything. If you are going to want a factura, specify that before hiring a contractor or buying anything as the factura requirement will result in a higher price. Be aware that tax rules in Mexico change frequently. Talk to a Mexican accountant about income tax planning if you are planning to rent out your condo, preferably prior to buying. As with attorneys, interview many, obtain recommendations, and make sure that you feel comfortable that your accountant is competent. Decide in advance whether or not you want to set up a Mexican corporation. Because of the large transfer tax, you can’t easily switch title into or out of a corporation as you can in the U.S.

2.18 Be Aware That Capital Gains Taxes May be Higher Than You Expect

Capital gains taxes can be high. Your capital gains taxes go down the longer you own a place. Before you even buy, ask your accountant how Mexican capital gains taxes are calculated. Be aware that capital gains tax will reduce your rate of return, and keep capital gains tax in mind when contemplating selling. Capital gains taxes are calculated based on peso values. If the peso goes down, you have a gain even if you sell at break-even in dollar terms.

2.19 Be Aware Of U.S. Rules on Foreign Trusts

You now have a foreign trust. If you are an American citizen or resident, you theoretically need to file special documents with the IRS that few accountants know about, form 3520 and 3520A. If you don’t do it in time (and it isn’t the normal tax deadline), the penalties can be pretty drastic. The IRS will likely attempt to correspond to the fiduciary bank in Mexico instead of with you about these forms and the bank will likely ignore the letters. You may be being assessed penalties and interest without knowing about it. Talk to an accountant in the U.S. about income tax planning, prior to buying in Mexico. If you are an American, ask about forms 3520 and 3520A. There is an argument that a fideicomiso is not a trust but I have not seen any decision from a tax court one way or another.

Consider whether income tax would be higher if you are a resident of the U.S. or a resident of Mexico and consider adjusting your plans accordingly. A certain amount of U.S. income is except from U.S. income tax, if earned abroad. There are double taxation treaties, and complex rules involved, so seek competent counsel. Some accountants may not be familiar with such complex issues and tax treaties. If it seems like the IRS is not acknowledging your forms 3520 and 3520A, it is probably because they are sending letters to Mexico. Have your accountant contact them and verify that everything is ok.

2.20 Understand The Risks of Using Financing Contracts

Financing is increasingly available in Mexico. Not prevalent, and at very high interest rates, but it does exist. Having a bank analyze the condition of title may help increase the odds that you will get good title. Be aware that it is risky to use developer financing. Typical contracts say the developer keeps title until you pay everything off. If they go bankrupt in the meantime, you can lose everything. I have heard that it can also take some time to get a lien removed after you pay off a loan. Hire an attorney to review financing contracts.

2.21 Consider the following quote from the U.S. Department of State Consular Information Sheet for Mexico

“Mexican authorities have failed to prosecute numerous crimes committed against U.S. citizens, including murder and kidnapping. Local police forces suffer from a lack of funds and training, and the judicial system is weak, overworked, and inefficient. Criminals, armed with an impressive array of weapons, know there is little chance they will be caught and punished.” If murderers are running around loose, consider how important your little title dispute is likely to be. Avoid any activity that might require using the legal system. Consider adding binding arbitration clauses to your Offer and other contracts. Discuss this option with your attorney.

2.22 Shop For Property Managers Before Buying

If you want to periodically use a property yourself, but also rent it out when you are not using it, you will need to find a manager who is willing to do short term rentals. I have found that these can be hard to find. And this does not necessarily work as well as 6-12 month leases in terms of cash flow, because of substantial vacancies and competition with hotels and timeshares, which are sometimes overbuilt. You will need to pay IVA value added tax on furnished rentals, as well as income tax. You will probably have to go through a couple of managers before you find one who is competent AND good at finding renters. The most successful owners are actively involved in finding renters for their own properties. Some managers may be tempted to not provide you with all the income they receive. Interview some property managers and other property owners before deciding whether or not to buy a condo you intend to rent out.

2.23 Be Aware That It Is Sometimes Hard To Sell In Mexico

When buying, make low offers and be patient. You’d be surprised. A lot of owners just want out badly for whatever reason (e.g., strong negative cash flow due to high condo association fees), and capital gains isn’t that important to them. They may have experienced a shakedown and suddenly want out.

2.24 Be Aware That Commissions Will Be High When You Sell

Standard real estate commissions are 10%. There are big savings to be made by avoiding properties that are on the MLS. But you need the advice of someone who knows the market. Don’t waste your time with agents who can’t tell you what prior sold prices have been. . Many people selling real estate are not licensed. Many do not know which properties have title problems or may not care, figuring that is a problem that can be worked out during the closing process. Some property managers or condo association managers may be able to help you find a condo at a reduced commission. The real estate agents, whether members of the MLS or not, are not legal experts and will not guarantee you clean title. But they are very competitive because a commission is very big money. Make property managers, other owners, and condo association managers your first source of information. Don’t expect an agent to ensure that you will get clean title. A lawyer can better protect you than an agent, particularly a lawyer you find on your own. Make sure they are competent and ask questions to make sure there are no conflicts of interest. Other American owners will give more candid advice about a complex than those with a vested interest in making a sale.

2.25 Expect Shakedowns

For one of the complexes that I own, the water and sewer department, called OOMSAPAS, periodically audits condo projects. They come out to the property and review water and sewer connections, ask for documentation, and in nearly every case returns with letters outlining improper use, improper sewer connections and management, and incorrect water connections. The always find fault and demand restitution. The standards for the fines are arbitrary. To appeal these fines is incredibly difficult and requires payment of fines to a tribunal before the dispute will be heard. The fines can go back 5 years as is allowed by Mexican law. In my complex, they demanded over 26,500,000 pesos, gave us 3 days to pay, and threatened having sewer connections capped if the HOA did not comply. The fines can be negotiated down but the OOMSAPAS has the ability to close off sewer drains and disconnect water. They did so in our complex. If this happens to you, you will want to hire a special lawyer who has experience negotiating with whatever government officials or services are shaking you down, in order to reduce the amount you need to pay. Someone from the immigration department also came to the HOA office to demand a list of foreign owners.

2.26 Corruption

According to Wikipedia, corruption in Mexico has permeated several segments of society – political, economic, and social – and has greatly affected the country’s legitimacy, transparency, accountability, and effectiveness.[

Transparency International‘s Corruption Perceptions Index scored Mexico at 31 on a scale from 0 (“highly corrupt”) to 100 (“very clean”). When ranked by score, Mexico ranked 126th among the 180 countries in the Index, where the country ranked first is perceived to have the most honest public sector. The best score was 90 (ranked 1), the average score was 43, and the worst score was 11 (ranked 180). Corruption may affect you if you have legal disputes, need permits to build on raw land, or need to deal with government officials (e.g., immigration department, tax department, etc.).

2.26 Socialism

There is a rich history in Mexico of socializing private property, particularly foreign-owned land. Look up Emiliano Zapata, Alvaro Obregon, and Luis Echeverria, who all redistributed private land. Maybe their actions were justified based on the situations of the times. But if a left-leaning President is eventually elected in Mexico, might he or she follow a Chavez-style approach to foreign land ownership given this history? Use risk capital, not your life savings.

3. Financing Options for Buying Property in Mexico: What You Need to Know

Securing financing in Mexico can be tricky. Most foreigners pay cash, but there are sometimes other options, such as Mexican mortgages, developer financing, and cross-border loans, each with unique requirements and terms. Here’s a guide to help you understand the best financing options for your purchase.

3.1 Cash Purchases

- Cash purchases are the most common for foreign buyers in Mexico, as it simplifies the transaction and speeds up the process. However, if you’re transferring large sums, be cautious of exchange rate fluctuations, as these can affect the overall cost of the purchase.

- Working with a trusted currency exchange service can help lock in favorable rates and reduce transaction fees, which can make a difference when transferring significant amounts.

3.2 Mexican Mortgages for Foreign Buyers

- Some Mexican banks offer mortgages to foreigners who have a resident visa. Mortgage terms in Mexico are typically short before adjusting, and interest rates are typically significantly higher than in the U.S., e.g. 6-9% higher. This should tell you something about the risks.

- When applying for a mortgage in Mexico, you’ll likely need to provide documentation such as a valid visa, proof of income, and possibly a down payment of 20% to 40% of the property’s price. Working with a Mexican bank that specializes in foreign buyers can help simplify the process. Be aware that removing the lien after the loan is paid off may take significant time and effort.

3.3 Cross-Border Loans

- I have heard that some U.S.-based lenders offer cross-border loans. This is similar to private lending or hard money loans. These loans can allow you to buy property without dealing with Mexican banks, but they often require high credit scores and substantial down payments. Expect higher than typical interest rates, again, if you are able to find one of these at all.

4.3 Developer Financing

- If you’re buying property directly from a developer, you may have the option of developer financing, where the developer acts as the lender. Developer financing can be more flexible, especially in popular tourist areas with new developments, where the developer may offer low down payments and no credit checks.

- Be aware, though, that developer financing terms are often shorter (3 to 5 years) before a balloon payment is due and may have higher interest rates than traditional bank loans.

- Also be aware that title typically remains in the name of the developer until the loan is paid off. If the developer goes bankrupt before the loan is paid off, you may never be able to get title.

4.4 Using Home Equity Loans from Your Home Country

- After cash purchases, this is probably the second most common type of financing used by American purchasers of Mexican real estate. Many foreign buyers choose to finance their Mexican property by tapping into home equity from a property they already own in their home country. This approach allows buyers to sidestep Mexican lending requirements altogether.

- While this strategy can offer favorable interest rates, it comes with risks, as it puts your primary residence as collateral. Consulting with a financial advisor to assess the benefits and risks is highly recommended.

5. How to Rent Out Your Property in Mexico: Tips for New Real Estate Investors

Renting out property in Mexico is rarely a profitable venture, particularly after income taxes, repairs, rip-offs, non-paying tenants, repairs of poorly constructed buildings, and shakedowns. From understanding local regulations to managing tenants and maximizing occupancy, here’s a guide to successfully renting out your property in Mexico so that you can at least (hopefully) cover your HOA fees. Don’t expect net rents to cover a mortgage payment, though.

5.1 Understand Local Rental Regulations

- While Mexico is generally tenant-friendly, with evictions taking several months, specific rental regulations vary by state and municipality. Offering short term rentals to Americans may reduce your need to do evictions but typically comes with long periods of vacancy during summer and fall. Property managers that offer management services for short term rentals charge incredibly high commissions, such as 25% of rent. Short-term rentals in tourist areas may require special permits, while some cities may have additional regulations on vacation rentals to manage local housing supply.

- Be sure to research local rules and consider consulting a real estate lawyer to ensure you’re compliant with regulations like tax reporting and permitting.

5.2 Registering for Rental Taxes

- Rental income in Mexico is subject to tax, whether you’re a resident or foreign investor. You’ll need to register with Mexico’s tax authority (SAT). You will also have to file a tax return in the U.S. Mexican taxes will likely be higher than U.S. taxes so there will typically be nothing to pay in the U.S. after deductions. Depreciation schedules for U.S. taxes will be different than for U.S. rental properties.

- You typically need to make two monthly tax filings in Mexico; one for income tax and one for sales tax/value added tax. This is in addition to the typical annual Mexican tax return.

- Different Mexican accountants will calculate your Mexican taxes differently. Some professionals have very low skill levels. Make sure to interview several accountants and find one whose explanations make sense relative to what you read independently about Mexican income taxes and value added taxes.

5.3 Marketing Your Property to Maximize Occupancy

- To attract tenants, particularly tourists, effective marketing is key. Consider listing your property on popular rental platforms like Airbnb, Vrbo, and Booking.com to reach a wide audience. You can also work with local vacation rental agencies that specialize in attracting international guests.

- Make your listing stand out with high-quality photos, accurate descriptions, and clearly listed amenities. Highlighting features like proximity to beaches, city centers, or popular attractions can help attract more bookings.

5.4 Set Up a Competitive Pricing Strategy

- Pricing your rental competitively is essential, and rental rates can fluctuate based on location, season, and amenities. Research similar properties in your area to get an idea of appropriate pricing and consider adjusting your rates based on peak tourist seasons and local events. AirDNA is useful for this.

- You may also want to consider offering discounts for longer stays or providing added perks, such as complimentary cleaning or concierge services, to make your property more appealing.

5.5 Managing The Property Remotely

- If you don’t live nearby, hiring a local property management company can be a great way to ensure your property is well-maintained and your guests are taken care of. A good property manager can handle cleaning, repairs, guest check-ins, and even provide concierge services.

- Alternatively, if you prefer to manage it yourself, consider hiring a reliable local cleaner and handyman. Using smart home technology like keyless entry and remote monitoring can also help with remote management. Exterior cameras are highly recommended. If a break-in occurs, don’t expect the local police to recover anything.

5.6 Furnish Your Property with Guests in Mind

- Furnishing the property to appeal to renters can increase occupancy rates. Durable furniture, high-quality bedding, and basic amenities like Wi-Fi, air conditioning, and kitchen supplies are highly recommended. Be aware that furniture is very expensive in Mexico.

- For short-term rentals, adding thoughtful touches like beach towels, local maps, or a guide to nearby attractions can enhance the guest experience and encourage positive reviews.

5.7 Collect Security Deposits and Set Clear Rules

- To protect against potential damages, collect a security deposit from renters and outline clear rules in your rental agreement. Common rules include restrictions on smoking, pets, and parties, as well as guidelines for check-in and check-out times. You will also want to read your HOA rules and make sure that tenants understand and comply with them.

- Be transparent with guests about expectations, and consider providing a written handbook or welcome guide to clarify policies. This can help avoid misunderstandings and ensure a smooth rental experience.

5.8 Encourage Positive Reviews

- Positive reviews are essential for building credibility and attracting more guests, especially on platforms like Airbnb. Providing exceptional service, fast communication, and addressing issues promptly can help earn glowing reviews.

- Follow up with guests after their stay to thank them and gently encourage them to leave a review. Satisfied guests are more likely to return and recommend your property to others.

5.9 Track Rental Income and Expenses for Financial Success

- Keeping detailed records of your rental income and expenses is crucial, not only for Mexican and U.S. tax purposes but also for assessing your property’s financial performance. Tracking maintenance costs, management fees, utilities, and taxes helps you understand your net income and optimize your rental strategy.

- Using accounting software or hiring a local accountant can streamline record-keeping, making it easier to file accurate tax returns and stay financially organized.

FAQs About Mexico Real Estate

1. Can Americans Buy Real Estate In Mexico?

Yes, Americans can buy real estate in Mexico. However, within restricted zones (e.g., areas close to the coast or borders), Amerians must use a Fideicomiso or Mexican corporation to hold property title.

2. What Is A Fideicomiso, And Why Is It Important?

A Fideicomiso is a bank trust that allows foreigners to hold title in restricted zones. The bank acts as the trustee, and you, the foreigner, are the beneficiary. It provides foreigners legal rights to beneficially own and sell property within restricted areas. Be sure that the bank you choose is known to be efficient in transactions as they will have to sign documents when you buy or sell. Ideally, they should have local representatives that handle fideicomisos instead of handling fideicomisos only from Mexico City.

3. Is Title Insurance Necessary For Purchasing Property In Mexico?

Yes, title insurance is highly recommended for Mexican real estate transactions but must be demanded as it is not a normal part of the closing process. U.S.-issued title insurance can protect you against title flaws and may be enforceable in U.S. courts if issued by a U.S. company (as opposed to a Mexican company or franchise with the same name as a U.S. company).

4. Are There Risks Associated With Buying Ejido Land?

Yes, buying Ejido land is very risky. Ejido land is communal land, and disputes over ownership can be complex and typically favor the Ejido. It’s generally advised to avoid purchasing such land or houses on such land.

5. How Do Mexican Labor Laws Affect Property Purchases?

Labor unions can place liens on properties under construction if workers are unpaid, leading to complications in clearing title. They may have a claim to wages that would have been paid during the entire period of a work stoppage. Verifying clean title before purchasing can help avoid these issues.

6. Who Can I Trust With My Earnest Money And Purchase Funds?

Mexican escrow accounts may not be insured bank accounts, and some escrow agents and real estate agents have been known to abscond with client funds. An escrow agent who uses a U.S.-based escrow bank accounts offers more security and transparency in managing your funds.

Conclusion

Buying real estate in Mexico can be a fun adventure and lifestyle choice if you only use risk capital with an understanding that there is a risk that you may completely lose your investment or run into significant headaches. By following these tips and understanding potential risks, you can navigate the market more confidently and reduce your risks. From avoiding Ejido land, to demanding title insurance, and using a U.S. escrow account, knowing what to look for can save you from costly mistakes if you are willing to take the significant risks involved in investing in a country with a weak legal system, history of redistributing private property, and problems with corruption and cartels.

In my years of investing in Mexico, I have seen it all, despite avoiding privatized Ejidos and hiring lots of help. A crooked real estate agent who collected 10% earnest money from multiple buyers and fled, a crooked escrow officer who did the same thing, a slow and inefficient legal system that requires you to pay before anyone will investigate, shakedowns by government officials and utilities. If you want to proceed anyway, please let me introduce you to some of my contacts. You will not pay any extra for this. At most, I’ll ask the real estate agent to pay me a small referral fee. Just click on the contact button or find me on LinkedIn.

In this guide on “How to Buy Mexico Real Estate,” we’ve covered essential steps to help ensure a safe and successful property purchase. Remember, a knowledgeable local attorney and title insurance are invaluable resources.